Countercyclical capital buffer: 3rd quarter of 2024

Based on data from the second quarter of 2024, Banka Slovenije is maintaining its countercyclical capital buffer rate for exposures to Slovenia at 1.0% of the total risk exposure amount. Banks must comply with the countercyclical buffer requirement from January 1, 2025 onwards.

The countercyclical capital buffer rate for Slovenia between December 31, 2023 and December 31, 2024 stands at 0.5% of the total risk exposure amount.

The buffer rate of 1.0% represents a positive neutral countercyclical capital buffer rate, which entails a buffer rate of 1.0% in a standardised or neutral risk environment. The standardised or neutral risk environment is one where cyclical risks are neither excessively high nor excessively low (realised), and are being maintained at a stable level.

Definition of standardised or neutral risk environment

The standardised or neutral risk environment is one where cyclical risks are neither excessively high nor excessively low, and are being maintained at stable levels. Individual risk indicators, model estimates and a number of additional indicators (e.g. the neutral environment indicator) are used to assess the phase of the financial cycle and the standardised or neutral risk environment. The attention is on whether individual indicators and model estimates deviate from their normal evolution. Because the individual indicators or model estimates can present a mixed picture, expert judgment of all the qualitative and quantitative information available also plays a significant role in the final decision with regard to the phase of the financial cycle and the intensity of systemic risk. In general the neutral risk environment can be quantitatively defined as a situation when the composite indicator is stable and/or the neutral environment indicator (see Figure 1) is fluctuating around zero. The expectation is also that in the standardised or neutral risk environment the banking system is resilient to systemic risks, operates profitably, and does not take up excessive risk.

The calibration of the level of the positive neutral rate is based on the historical average of the signalled value of the countercyclical capital buffer, based on the results of stress tests and expert judgment. The decision on the level of the positive neutral rate also took account of the effectiveness of the potential release of countercyclical capital buffer. The buffer rate must be sufficiently high to also allow for an effective partial release.

Indicators for the assessment of the neutral risk environment, and build-up of the countercyclical capital buffer above the positive neutral rate

Banka Slovenije’s analytical framework for assessing the neutral risk environment and for determining the countercyclical capital buffer rates is primarily based on three methodologies. The first methodology is based on individual risk indicators, including the credit-to-GDP gap (see Table 1). The second methodology is based on a composite indicator (see Figure 3), while the third methodology is based on the neutral environment indicator (see Figure 1). Banka Slovenije has been using the first two methodologies for some time now, while the neutral environment indicator has been added to our analytical framework to assist in the assessment of the phase of the financial and business cycle, and thus of the neutral risk environment, and to assist in deciding on the countercyclical capital buffer rate.

In addition to the described indicators, Banka Slovenije also monitors other risk indicators that are significant to defining the phase of the financial cycle. These indicators are used in the risk assessment conducted by Banka Slovenije every quarter and presented in the risk and resilience dashboard.1 They include the most important indicators for assessing the risks inherent in the macroeconomic environment, credit risk, credit activity, interest rate risk, funding risk, income risk and the risk inherent in the real estate market. There is also consideration of the banking system’s resilience to the aforementioned risks, with an overview of solvency and profitability of the banking system, liquidity in the banking system, and the resilience of businesses and households to shocks affecting loan repayment capacity. The key to the final decision on a appropriate countercyclical capital buffer rate is expert judgment, which also take account of other quantitative and qualitative factors.

1) Neutral environment indicator

The definition of the standardised or neutral risk environment is based on the neutral environment indicator. This in turn is based on a multivariate structural time series model (STSM). The assumption under this methodology is that a particular time series is composed of three main components: the trend, cyclical components, and irregular components. The structure of the STSM allows for the interaction of various time series and cycles, in our case the real business cycle (GDP), the financial cycle (household loans)2 and the residential real estate prices cycle, which in theory represents a good approximation of the link between the real business cycle and the financial cycle (Lenarčič, 2021).

To calculate the neutral environment indicator, it is necessary to upgrade the described methodology of the STSM, having assessed all three types of cycle with the model. The estimated trend component of the time series is first subtracted from the actual time series for real GDP, real household loan stock, and real residential real estate prices.3 This yields the deviations from the trends in individual variables. The deviations are illustrated in Figure 1 (the deviation in GDP with the blue dashed line, the deviation in household loans with the green dashed line, and the deviation in residential real estate prices with the orange dashed line). The estimated trends in these variables are normalised to zero in Figure 1.4 The composite neutral environment indicator is illustrated as the weighted combination of all three deviations in the individual variables, according to the following key: 60% financial cycle (which is of most interest to us as the macroprudential supervisor), 30% real business cycle, and 10% residential real estate prices cycle. It is then only necessary to determine the bounds of the neutral environment, i.e. an environment where the countercyclical capital buffer is neutral (at 1.0%). The condition of neutrality at 1.0% is determined within one standard deviation of the composite neutral environment indicator.

The neutral environment indicator is currently located in the middle of the neutral corridor, which means setting the positive neutral buffer rate at 1.0% (Figure 1).

Figure 1: Neutral environment indicator

.png)

* Note: For a more precise description of the methodology, which is based on the calculation of the real business cycle and financial cycle using a multivariate STSM, see Lenarčič (2021). The variable d_HH_Loans represents the deviation (in %) of the actual (in real prices) household loans series from the long-term estimated trend (in real prices) of the household loans series, normalized to 0. The variable d_RRE represents the deviation (in %) of the actual real house price series from the long-term estimated trend of the real house price series, normalized to 0. The variable d_GDP represents the deviation (in %) of the actual real GDP series from the long-term estimated trend of the real GDP series, normalized to 0. The green corridor represents +/- one standard deviation of the neutral environment indicator series. In this corridor, we assume that the environment is neutral and signals a neutral level of the positive neutral countercyclical buffer at 1%.

Sources: Banka Slovenije, SORS, own calculations

2) Individual risk indicators

Banka Slovenije calculates a buffer guide5 on a quarterly basis in accordance with Article 233 of the Banking Act (Official Gazette of the Republic of Slovenia, Nos. 92/21 and 123/21 [ZBNIP]; hereinafter: the ZBan-3). The buffer guide is a meaningful reflection of the credit cycle and risks due to excess credit growth in Slovenia, and takes into account the specificities of the Slovenian economy. In setting the buffer rate Banka Slovenije takes appropriate account of the methodology of the BCBS (2010)6 and the ESRB (2014).7

Recommendation ESRB/2014/1 defines the private-sector credit-to-GDP gap, i.e. the deviation in the private-sector credit-to-GDP ratio from its long-term trend as a key indicator in setting the buffer rate.8 This indicator signals potential excessive credit growth in relation to economic growth (see Figure 2).9 Five indicators have been selected alongside the credit-to-GDP gap:- annual growth in used residential real estate prices (a measure of the potential overvaluation of property prices),

- annual growth in lending to the domestic private non-financial sector (a measure of developments in lending),

- average risk weight (a measure of the strength of bank balance sheets),10

- return on equity (a measure of the strength of bank balance sheets), and

- the ratio of credit to gross operating surplus (a measure of private-sector indebtedness).

The following criteria were taken into account in selecting the individual indicators:

- the indicators should cover various risk factors,

- the indicators should have sufficient predictive power in forecasting a crisis,

- the time series of the indicators should be long enough to allow for static analysis11 of the suitability of the indicator (points iv and v),

- the indicators should activate the buffer in periods of excessive lending to the real economy,

- the indicators should not activate the buffer (too frequently) in periods of moderate credit growth,

- the indicators should cover a wide area of the banking system and the wider system, i.e. they should not be partial.

Table 1: Individual risk indicators

| Indicator | Average value (Q1 2000 to Q2 2024)* | Indicator value in Q2 2024 |

| Credit-to-GDP gap | -10.7% | -15.6% |

| Annual growth in used residential real estate prices (available since 2001) | 6.1% | 7.7% |

| Annual growth in lending to domestic private non-financial sector | 7.8% | 0.8% |

| Average risk weight | 61.2% | 51.3% |

| Return on equity | 3.1% | 19.5% |

| Ratio of credit to gross operating surplus | 4.0 | 1.7 |

Notes: The average is cited solely for orientation purposes. Owing to data availability, the average value of the indicator of annual growth in used residential real estate prices is calculated for the period of Q1 2001 to Q2 2024.

Sources: SORS and own calculations

The table shows that the credit-to-GDP gap is negative (in the amount of 15.6%), whereby the credit-to-GDP ratio stands at 52.4% (see Figure 2). The gap between the credit-to-GDP ratio and the long-term trend is still profoundly negative, on account of the extremely high growth in lending to the private non-banking sector in the period before the global financial crisis.12 Growth in credit to the private non-financial sector increased to 0.8% in the second quarter of 2024, for 0.2 percentage points on the previous quarter. The average risk weight (51.3%) remained at a similar level as in the previous quarter. Compared with the previous quarter, the growth in used residential real estate prices decreased by 1.4 percentage points to 7.7%. The banks performed well in the second quarter of 2024: ROE stood at 19.5%. Given that the banks’ high profits are not dependent on the take-up of excessive risks, the high ROE is not problematic. The ratio of credit to gross operating surplus, which is a measure of private-sector indebtedness and reflects the corporate sector’s capacity to finance debts, remains low.

Figure 2: Credit-to-GDP gap

.png)

Note: The calculation of the credit-to-GDP gap includes all bank loans (by domestic and foreign banks) to the private non-banking sector (the non-banking sector excluding the government sector) before impairments. GDP is annualised as the sum of nominal GDP over the last four quarters. The trend in the credit-to-GDP series is estimated by means of a recursive Hodrick-Prescott (HP) filter with a lambda parameter of 400,000. The credit-to-GDP gap is the gap between the actual credit-to-GDP ratio and its trend.

Source: Banka Slovenije

3) Composite indicator

Since mid-2020 Banka Slovenije has additionally monitored a composite indicator that combines individual risk indicators that showed good predictive power in forecasting a crisis on the basis of data from euro area countries and from Denmark, Sweden and the UK. The risk indicators combined into the composite indicator are:

- bank credit to the domestic private non-financial sector relative to GDP (a measure of credit developments),

- overall real growth in credit (a measure of credit developments),

- the ratio of residential real estate prices to income (a measure of potential overvaluation of property prices),

- the debt-service-to-income ratio (a measure of private-sector debt burden),

- the ratio of the current account balance to GDP (a measure of external imbalances).

Various transformations (quarterly, one-year, two-year and three-year) were tested for each of these indicators with the aim of identifying those with the best predictive power. The two-year or three-year changes in the indicators have the best predictive power in forecasting a crisis. When these are used, the individual indicators rise or fall for approximately five years before the outbreak of a systemic financial crisis, and usually hit their peak or trough one to two years before the crisis, which are desirable attributes for early warning indicators.

The individual risk indicators are combined into a composite indicator so as to optimise the predictive power of the early warning of the crisis five to twelve quarters before the outbreak of the crisis. Figure 3 illustrates the value of the composite indicator in the second quarter of 2024, and the individual indicators’ contributions to the composite indicator. The composite indicator underwent a downward reversal in early 2023, as a result of lower credit growth and a decline in the current account surplus as a ratio to GDP. In the second quarter of 2024, the composite indicator remained at a similar level as in the previous quarter.

Figure 3: Composite indicator for Slovenia

.png)

Note: The sub-indicators of composite indicator are normalised by subtracting the economic neutral value and dividing by the standard deviation of the pooled indicator distribution acrosseuro area countries. Optimal indicator weights are chosen to maximise the early warning properties of the composite indicator. The advantage of the normalisation is that the units of the composite indicator have an intuitive interpretation as the weighted average deviation from the economic neutral value, measured in multiples of the historical standard deviation. More information about sub-indicators, normalization and weightetning available at: Anticipating the bust: a new cyclical systemic risk indicator to assess the likelihood and severity of financial crises.

Source: Banka Slovenije

Release of the countercyclical capital buffer and the neutral rate

The same indicators and model estimates used in the build-up of the buffer will also be used for the purpose of releasing the buffer to a positive neutral rate. The buffer may be reduced gradually or immediately, depending on the evolution of risks. If the buffer is built up to a rate of 2.5% or more, the release of the buffer to a neutral rate could be undertaken gradually, in the event of the cyclical risks gradually diminishing. In the event of a mild financial shock, releasing the buffer to a neutral rate could be sufficient to mitigate the consequences of the materialisation of risks. If it is assessed that releasing the buffer to a neutral rate is not sufficient, we will release the buffer in full. The indicators in the risk and resilience dashboard will also be of assistance in our assessment of whether it is an appropriate time to release the buffer, particularly the credit risk indicators, the solvency and profitability indicators, and the income risk indicators.

One of the indicators that the literature identifies as being positively correlated with the stock of and growth in household loans is the capital surplus (defined as the surplus in a bank’s capital funding over its minimum regulatory requirements and buffers).13 An additional indicator that can point to a contraction in lending is stricter lending standards at banks, which can be measured through the Bank Lending Survey. Model estimates can indicate changes in factors affecting the supply of and demand for lending.14

The release of the positive neutral buffer rate will depend on the materialisation of risks. One of the main indicators of the materialisation of risks is curtailed bank lending, a rise in non-performing exposures and a deterioration in the solvency of the banking system and with it its resilience. In addition to model estimates of the probability of a crisis and the existing methodologies for assessing the neutral environment and cyclical systemic risks, we will also take account of the quantitative information in the Banka Slovenije risk and resilience dashboard in the assessment of whether the time is right to release the buffer. The most important of these are the indicators for assessing credit risk, the banking system’s solvency and profitability, and credit activity.

The release of the countercyclical capital buffer is even more subject to expert judgment than the build-up of the buffer, and it is therefore extremely difficult to quantitatively define the threshold for when the time is right to release the buffer.

Requirement to maintain the bank's own countercyclical capital buffer

Pursuant to the Article 232 of the Banking Act, a bank must maintain its own countercyclical capital buffer equal to the amount of the total risk exposure multiplied by the weighted average of the countercyclical buffer rates calculated in accordance with the Decision on the calculation of the countercyclical capital buffer rate for banks and savings banks (Official Gazette of the Republic of Slovenia, No. 55/15, 42/16, 9/17 and 92/21 – Zban-3) on an individual and consolidated basis as applicable under Title II of Part 1 of Regulation (EU) No 575/2013.

For exposures to the Republic of Slovenia, a buffer rate of 0.5% shall be applied for the period from 31 December 2023 to 31 December 2024, and from 31 January 2025 a buffer rate of 1%. For credit exposures to other countries, a buffer rate shall be applied, which shall be determined and published by the designated authorities of those countries on their websites. The buffer rates for countries that are part of the EEA are listed on the ESRB website. For some countries that are not part of the EEA, the buffer rates are published on the BIS website.

1 The risk and resilience dashboard forms part of the Financial Stability Review and the Report on bank performance with commentary.

2 The methodology was also tested against corporate loans, whose data contains noise (loans from the rest of the world, one-off loans to large enterprises, etc.), and so household loans alone are taken into account for the needs of greater robustness in the dynamics of the neutral environment indicator. For similar reasons the calculation of the neutral environment indicator does not take account of all loans to the private non-banking sector, as the dynamics in corporate loans and household loans are mutually exclusive at certain times, which consequently makes it harder to make a good-quality assessment of cycles.

3 All data is adjusted for inflation and is entered in the model as real values.

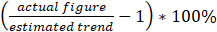

4 The deviation is calculated as  .

.

5 In accordance with the Recommendation of the ESRB of 18 June 2014 on guidance for setting countercyclical buffer rates (ESRB/2014/1), the buffer guide is not intended to give rise to an automatic buffer setting or to bind the designated authority.

6 Basel Committee on Banking Supervision (2010). Guidance for national authorities operating the countercyclical capital buffer.

7 ESRB (2014). Operationalising the countercyclical capital buffer: indicator selection, threshold identification and calibration options.

8 The credit-to-GDP gap is calculated and published in accordance with Articles 233 and 238 of the Banking Act.

9 Analysis by the BCBS shows that the credit-to-GDP gap is a useful starting point for guiding decisions on countercyclical capital buffer rates, but its performance varies over time and across countries. Given the diversity and the dynamic nature of financial systems, the specificities of national economies, and the significant differences in the availability of data in the EU, the designated authorities must take account of a range of information when assessing the risk level in the system as a whole, and must set the buffer rate accordingly. This information includes additional indicators that warn of an increase in risk at the level of the system as a whole. The quantitative and qualitative information used in this assessment, including the buffer guide and the additional indicators, lay the foundation for explaining and substantiating decisions on the buffer rate.

10 Because the calculations of indicators are based on past developments, it is necessary to subject the buffer rate signalled by the individual indicators to expert judgment, and to take account of any new findings. We consequently established that the indicator used in the past (LTD ratio) is less suited in the current circumstances to identifying risks in the segment of bank balance sheet strength. The LTD ratio would have good predictive power for a crisis similar to the global financial crisis, but in the current situation there is practically no longer any funding of loans through borrowing at banks in the rest of the world, which means that the likelihood of the LTD ratio rising sharply again is low. In the pursuit of effective risk identification, as an alternative to the LTD ratio we included an indicator in the third quarter of 2023 that in accordance with the requirements of Recommendation ESRB/2014/1 reflects the change in bank balance sheet structure and bank business models (a measure of the strength of bank balance sheets), similarly to the LTD ratio.

11 Static analysis on the basis of historical data (roughly 2004 to 2008) is used to assess what the dynamic of the buffer would be during a period of increasing imbalances in the banking system and in the wider system. The analysis neglects that the banks’ behaviour would most likely have altered had the buffer been active at that time.

12 Growth in credit to the non-banking sector exceeded 35% in 2007. The private-sector credit-to-GDP ratio stood at 65.8% at the beginning of 2005. By the end of 2008 the ratio had risen by 44.4 percentage points to 110.2%, before peaking at almost 120% in the third quarter of 2010. The high credit growth, which outpaced GDP growth for a lengthy period, drove a sharp rise in the estimate of the long-term trend. As a result of the pronounced slowdown in credit growth after the global financial crisis and the sharp decline in the credit-to-GDP ratio, the credit-to-GDP gap fell sharply, reaching its lowest level (of -41%) in mid-2016. Since 2016 the credit-to-GDP gap has undergone a sustained narrowing.

13 For a review of the literature on this subject, see BIS (2022) Buffer usability and cyclicality in the Basel framework.

14 The basic description of the model infrastructure is given in Box 1.3 Empirical analysis of supply of and demand for corporate loans in the October 2021 issue of the Financial Stability Review.