Press release - Bank of Slovenia’s reaction to the Advocate General’s opinion: additional clarifications

A number of the commentaries that appeared in the media yesterday in connection with the Advocate General’s opinion in case C-526/14 (Kotnik and others) were misleading. Common to the majority of the responses were a failure to sum up the Advocate General’s complex opinion in full, or the interpretation of the Advocate General’s findings, positions and guidance out of context. Given the position and property interests of some of those initiating proceedings before the Constitutional Court, for the Bank of Slovenia interpretations of this kind were fully expected and nothing new, but it cannot accept them in any way.

Below the Bank of Slovenia gives its responses to the key questions raised in public yesterday in this connection.

1. Is the Banking Communication issued by the European Commission really not binding upon Member States?

In his opinion the Advocate General states that the Banking Communication is neither de jure nor de facto a binding EU regulation, as Member States are not obliged to transpose it into their national legislation.

In its petitions before the national courts and the Court of Justice the Bank of Slovenia never claimed the Banking Communication to be a “binding regulation”. Claims by certain commentators to the contrary thus do not hold.

The Bank of Slovenia’s position at all times has been that the European Commission’s Banking Communication is “soft law”, i.e. the European Commission’s interpretation with regard to the application and implementation of the general provisions of the Treaty on the Functioning of the European Union concerning state aid. State aid is in principle not allowed, for reasons of protection of competition. This interpretation has indirectly binding effects on those countries wishing to approve state aid to banks, as the measures have to satisfy the requirements deriving from the Communication.

A country that intends to approve state aid measures must obtain the European Commission’s permission before the application of such measures. For the approval of state aid measures a country must ensure that the requirements set out by the European Commission in connection with the Communication are met in connection with the specific measure. Otherwise the European Commission would have to deny the approval of state aid.

In his opinion (points 39 to 41) the Advocate General clarified that a Member State may of course propose measures in connection with intended state aid that do not meet the requirements from the Communication, but in so doing should cite extraordinary circumstances for which reason the requirements from the Communication are not relevant (because their implementation would constitute an infringement of the Treaty on the Functioning of the EU or the Charter of Fundamental Rights). In this connection the Advocate General states that a country would find it difficult to de facto prove such circumstances, or to convince the European Commission of them.

Were a country to submit a proposal without taking account of the requirements from the Communication, and were it to fail in its arguments for a derogation from or change in the Communication, it thereby risks the denial of its proposal for the approval of state aid. In connection with a request for the approval of state aid a country must of course assess whether the circumstances of the actual case (of state aid) allow for a claim that the European Commission’s requirements are not in accordance with the TFEU or the Charter of Fundamental Rights.

Such an assessment was made by Slovenia in 2013, with a conclusion that the European Commission’s requirements for the total write-down of equity and subordinated capital instruments in the case of five insolvent banks (in light of the established financial situation at the banks, the assessment of which was conducted by independent international appraisers) are not incompatible with the TFEU or the Charter of Fundamental Rights. Both the Slovenian government and the Bank of Slovenia explained as follows in the subsequent proceedings before the Constitutional Court.

- The total write-down of subordinated instruments at the banks, which according to the results of the comprehensive assessment made by independent appraisers were disclosing substantial negative capital, does not constitute interference in property rights in connection with the investor’s investment, as these rights would be hollow in substantive terms in the event of the bank’s insolvency (if in bankruptcy the creditor would not be repaid even in part). The write-down measure therefore merely entails the formal overturning of property rights as a result of loss coverage, and does not constitute an infringement of the fundamental right to property.

- The write-down of equity and subordinated capital at five banks in 2013 would also not constitute circumstances that could endanger the stability of the financial system (the write-down of these instruments undoubtedly had an adverse impact on the performance of other financial entities and individuals who held investments in these instruments, but in the assessment of the Bank of Slovenia the impact was not sufficient to endanger financial stability in Slovenia).

The position with regard to the legal nature of the Banking Communication and its effects on Member States was confirmed by the Advocate General in his opinion, viz.:

1. in the answer to the first question: that the Banking Communication is not binding on Member States,

2. in the answer to the second question: that it is within the European Commission’s competence to set out general requirements for state aid in the form of the Banking Communication, which for the Commission represents a binding interpretation of the TFEU with regard to the state aid rules, while Member States must show in the procedure before the European Commission for the approval of state aid that the conditions for the approval of the aid have been met in the specific case, either by meeting the Commission’s requirements on the basis of the Communication, or by showing circumstances that require the Commission to derogate from the requirements in the Communication (allowing a derogation as envisaged in the Communication) or to adopt an amendment to the Communication.

2. Why was it necessary to amend legislation in Slovenia with regard to the write-down of equity and subordinated capital instruments?

As the Advocate General clarifies, a Member State requesting the approval of state aid measures by the European Commission decides independently on how the requirements are to be met. The amendment of legislation is merely one of the options, not the only option. The Banking Communication also does not stipulate requirements of any kind in this connection whereby a country would have to amend legislation to qualify for state aid.

In light of the above, it is necessary to accept the finding that the manner in which requirements are met is to a great extent dependent on the broader economic and political situation in which they are being carried out: timely action is thus of exceptional importance to prevent a further deterioration in the position, and to allow less invasive resolution measures to be applied, including potential negotiations with various stakeholders and investors for the co-participation of private capital.

However, it should also be borne in mind that given the severity of the financial position and the urgency of action to safeguard the stability of the financial system, the toolkit of potential resolution methods can be very limited, and certain resolution methods, most notably the voluntary participation of private capital, are de facto (not de jure) excluded. The consequence is that the government decided to rescue the banks, which entails state aid. In particular, when the European Commission requires the total write-down of equity and subordinated capital instruments in connection with state aid measures with regard to negative capital at banks, and the possibility of the entry of a private investor is ruled out beforehand (or there is no time to find such an investor), the sole path to the realisation of the aforementioned requirements is de facto the amendment of legislation.

In the circumstances of 2013 Slovenia therefore did not have the option of meeting the requirements in the state aid procedure in any way other than an amendment of the law giving new powers to the Bank of Slovenia to impose an extraordinary measure ordering the total write-down of equity and subordinated capital instruments if investors would not be repaid even in part in the event of bankruptcy.

It should also be noted that the Banking Communication adopted in 2013 actually applies the principles formulated at that time as the standard for the resolution of banks, which were included in the legislative proposal for the bank resolution directive.

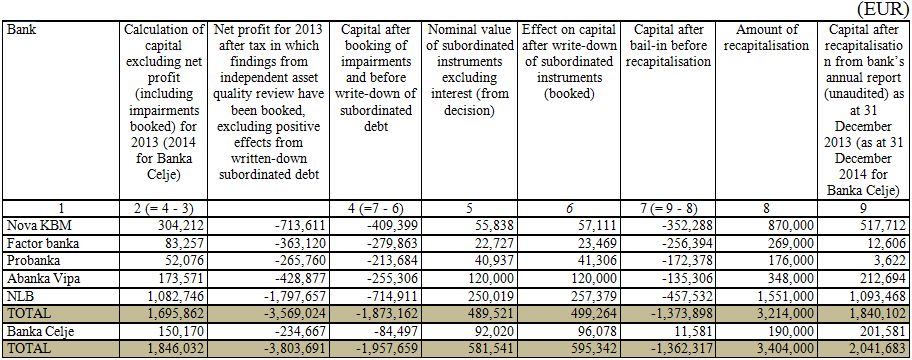

With regard to the financial position of the banks that requested state aid in 2013, the financial data from the banks’ audited annual reports reveals that the banks were de facto insolvent, which is also illustrated in the table below. The negative capital is confirmation that bankruptcy proceedings would have been initiated against the banks had the state aid measures not been applied.

Figures for bank capital before and after the implementation of the extraordinary measures by the Bank of Slovenia derived from the banks’ audited annual reports

Source: Report of the Bank of Slovenia on the causes of the capital shortfalls of banks and the role of the Bank of Slovenia as the banking regulator in relation thereto, the recovery of banks in 2013 and 2014, the efficiency of the system of corporate governance of banks under state ownership and the manner of resolving the consequences of the capital inadequacy of commercial banks, p 81. The entire report is viewable on the Bank of Slovenia website, under Other Publications on the Publications page.

For the purpose of determining the proportionality of measures of the write-down of equity and subordinated instruments, before imposing the measures the Bank of Slovenia obtained an independent assessment of the liquidation value of the banks in accordance with the law (the value of the assets in the event of the bank’s bankruptcy), which showed at all the banks that the owners and the holders of subordinated instruments would not even be repaid in part in the event of the bank’s bankruptcy, in light of the prescribed seniority of repayment. The figures for the estimated liquidation values for individual banks are illustrated on page 80 of the aforementioned report.

3. Are the European Commission’s requirements for the total write-down of equity and subordinated capital instrumetns compliant with the TFEU and the Charter of Fundamental Rights?

In his opinion the Advocate General clarifies that the European Commission’s requirements in the implementation of the Banking Communication (that the total write-down of equity and subordinated instruments be ensured in the particular case of aid, in light of the bank’s financial position) do not entail interference in investors’ fundamental rights if as a result of the measures taken the investors are not in a worse position than they would have been had the measures not been taken, i.e. in ordinary insolvency proceedings.

If the Court of Justice upholds the Advocate General’s opinion in its final decision, i.e. that when investors would not be repaid even in part in bankruptcy the European Commission may require the total write-down of equity and subordinated instruments, and that this does not constitute an infringement of the investors’ fundamental rights (by the Commission), it is impossible to simultaneously claim that in a Member State that met this requirement of the European Commission there has been an infringement of fundamental rights (i.e. interference in the investors’ property rights).

In light of the guidance provided by the Advocate General with regard to the question of the infringement of fundamental rights in connection with interference in the investors’ property rights by means of the write-down of equity and subordinated instruments, the Constitutional Court and other courts in Slovenia will therefore be able to conclude that in a case when the investors would not receive repayment of any kind in the event of ordinary bankruptcy proceedings, having regard for an assessment of the bank’s financial position (insolvency) and an assessment of the repayment of investors in bankruptcy (independent liquidation valuation), there is no interference in the fundamental right to property.

To sum up, the Advocate General’s opinion gives unambiguous confirmation of the compatibility of the bail-in instrument in the resolution of a bank via the write-down or conversion of equity and subordinated instruments, and the assessment of the likely repayment of investors in bankruptcy as a criterion for assessing the compatibility of the measures with the investors’ fundamental rights and the principle of proportionality. In essence the Advocate General responded to the criticisms of the applicants before the Constitutional Court (legitimate expectations, interference in property rights, the Bank of Slovenia’s new powers), and rejected them.

In the event of any decision by the Constitutional Court that the provisions of the law are anti-constitutional, the government will be held liable as the legislator.

Public Relations Department

Bank of Slovenia

More:

Press release - Bank of Slovenia’s reaction to the Advocate General’s opinion (18.2.2016)